Contribution Margin Per Unit Formula

Accordingly the contribution margin per unit formula is calculated by deducting the per unit variable cost of your product from its per unit selling price. It is possible to jump to step b above by dividing the fixed costs by the contribution margin per unit.

Contribution Margin Ratio Revenue After Variable Costs

Now take the difference between revenue per unit and cost per unit which will give you markup value.

. The contribution margin per shoe is 500000 250000 200000. Thus a break-even short cut is. Total revenue variable costs of units sold.

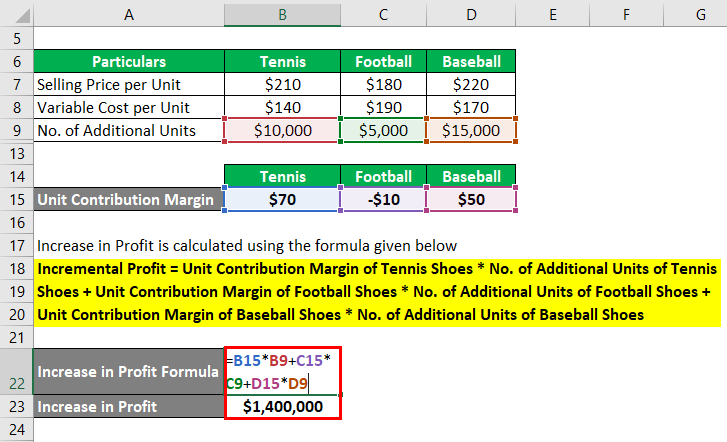

This represents the margin available to pay for fixed costs. The selling price per unit is 100 incurring variable manufacturing costs of 30 and variable sellingadministrative expenses of 10. To calculate the variable contribution margin perform the following calculation.

Contribution Margin Per Unit Per Unit Selling Price. For the year ended. Sales Variable Costs Sales To simplify things lets use the same amounts from the last example.

Variable costs per unit. Therefore you have a variable contribution margin of 20. Sometimes one may want to know the break-even point in dollars of sales rather than units.

Sales price - variable costs variable contribution margin. Gross Margin 38. Again this is your sales price per unit minus your variable costs per unit.

Again it should be noted that the last portion of the calculation using the mathematical equation is the same as the first calculation of breakeven units that used the contribution margin per unit. Contribution Margin Definition A contribution margin is defined as the difference between the revenue generated by. So if the price of your product is 25 and the unit variable cost is 5 the units contribution margin is 20.

Unit contribution margin per unit denotes the profit potential of a product or activity from the. As a result the contribution margin for each product sold is 60 or in totality for all units is 3M having a contribution margin ratio of 60 or 60. The variable cost per unit is 2 per unit.

In other words contribution margin per unit is the amount of money that each unit of your product generates to pay for the fixed cost. Gross Margin Formula Example 2. These are not committed costs as they occur only if there is production in the.

In cost-volume-profit analysis a form of management accounting contribution marginthe marginal profit per unit saleis a useful quantity in carrying out various calculations and can be used as a measure of operating leverageTypically low contribution margins are prevalent in the labor-intensive service sector while high contribution margins are prevalent in the capital. What are Variable Costs. The formula for contribution margin dollars-per-unit is.

The gross margin equation expresses the percentage of gross profit Percentage Of Gross Profit Gross profit percentage is used by the management investors and financial analysts to know the economic health and profitability of the company after accounting for the cost of sales. 30 - 4 1 5 20. We can represent contribution margin in percentage as well.

Once the breakeven point in units has been calculated the breakeven point in sales dollars may be calculated by multiplying the number of breakeven units by the selling price per unit. The amount thats left over is the combination of fixed expenses and profit. The contribution ratio can then be calculated by dividing the CM by the selling price per unit times the number of units sold.

The contribution margin is the difference between sales and variable costs. First find your contribution margin. Contribution margin per unit formula would be Selling price per unit Variable cost per unit Variable Cost Per Unit Variable cost per unit refers to the cost of production of each unit produced which changes when the output volume or the activity level changes.

The following part of the above formula is for your contribution margin ratio. Sales price per unit. Finally divide the markup value with the cost per unit to arrive at the markup percentage.

For example a company sells 10000 shoes for total revenue of 500000 with a cost of goods sold of 250000 and a shipping and labor expense of 200000. This ratio represents the percentage of sales income available to cover its fixed cost expenses and to provide operating income to a firm. This revenue per unit and cost per unit can be calculated by taking total revenue and cost and dividing it by the number of units sold.

Break-Even Point in Units Total Fixed Costs Contribution Margin Per Unit 1000 Units 1200000 1200. Alternatively it is known as the contribution to sales ratio or Profit Volume ratio.

Contribution Margin Ratio Formula Per Unit Example Calculation

Unit Contribution Margin How To Calculate Unit Contribution Margin

Contribution Margin Formula And Ratio Calculator Excel Template

No comments for "Contribution Margin Per Unit Formula"

Post a Comment